When THIS happens, big money will move into crypto!

There’s a huge obstacle keeping cryptocurrencies from becoming a mainstream investment. That is, the inability of large institutional investors to find a third-party custodian to hold it for them.

This is generally true not only for mutual funds and Exchange-Traded Funds (ETFs), but also pension funds and hedge funds.

Ari Paul of BlockTower Capital, a cryptocurrency hedge fund founded by former Goldman Sachs executives, put it this way:

“Institutional money started trickling into cryptocurrency in mid-2017, but it’s been slower than many (including myself) expected. That doesn’t mean it’s not coming. There are a lot of pieces that need to come together; one big piece being third-party custody.”

As a result, big-money institutional investors are waiting on the cryptocurrency sidelines. But custodian solutions are close to becoming a reality.

|

Northern Trust, a $10.7 trillion financial giant, is moving aggressively and quickly to expand its cryptocurrency services. The company announced that it will now offer custodial services for two cryptocurrencies — Bitcoin and Ethereum — to a few of its largest hedge fund customers.

Said Pete Cherecwich, president of Northern Trust:

“You can take anything today. You can take movie rights, you can take all sorts of entities, and you can create a token for those. We have to be able to figure out how to hold those tokens, value those tokens, do those things.”

Let me be clear: Northern Trust is not taking direct custody of those two cryptocurrencies.Instead, it’s offering accounting and tracking services for cryptocurrency investments. They will help hedge funds reconcile and validate the numbers they report with the actual amount on record at the customer’s cryptocurrency custodian.

Additionally, Northern Trust can help with other administration services. Things like anti-money-laundering reporting, crypto-trade reconciliations, and crypto pricing.

It’s a smart move on their part. This positions Northern Trust itself to become the first mover in crypto custodian services, which could turn into a multibillion-dollar revenue stream for it.

That won’t happen overnight, but the shares of Northern Trust (Nasdaq: NTRS) are likely to skyrocket when it can offer full-service crypto custodial services.

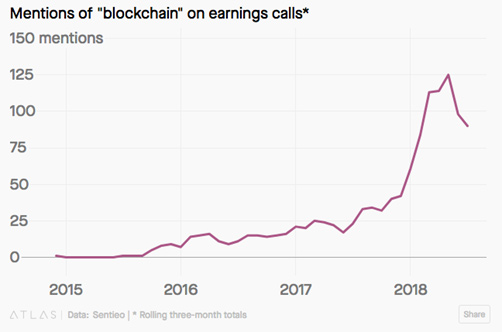

And this isn’t the only stock that could benefit from the coming cryptocurrency investment boom. Blockchain is being mentioned more and more frequently on corporate earnings calls for a reason: Adopting — or adapting to — this technology is going to be critical for almost any company’s success.

|

More importantly, that will open the floodgates for mainstream, institutional money to flow into cryptocurrency investing. With time, the peak crypto price levels of 2017 could look low by comparison.

I’m not saying that you should invest your life savings into cryptocurrencies tomorrow morning. But if you haven’t done so already, the time is right to open an account, dip your toe in the water, and prepare to ride one of the most profitable investment tidal waves of your lifetime.

Best wishes,

Tony