EOS has been on an absolute tear.

A month ago, it hit rock bottom at just $4. This week, it catapulted to an all-time new high of $23.

Think about that. If a share in Amazon could somehow have enjoyed a similar move, it would be trading for over $8,000 today.

Sure, in the past few days, the rocket engines thrusting EOS skyward have cooled somewhat. But our model tells us there’s a lot more upside potential.

Indeed, on the very first day we launched our Weiss Cryptocurrency Ratings on Jan. 24, 2018, EOS was at the pinnacle of our entire crypto list. And it has maintained that perch virtually nonstop.

That’s why we recommended investors get in on EOS when it was trading at around $8. And it’s why we told them to double down when it was near $4.

Another Good Reason Investors Can Get Excited About the Project

I won’t waste time telling you about all the factors that make up our Technology Index and Fundamental Index (where EOS scores well on most). You can read all about what goes into our ratings model on our website.

Today, I want to focus on this critical aspect: Leadership.

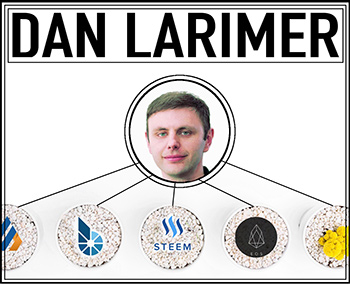

The team behind this project is led by Daniel Larimer, one of the most experienced and forward-thinking developers in the space.

His track record: Previous big wins already under his belt.

The first was BitShares, where Larimer pioneered a new design for blockchain technologies that boost their speed by orders of magnitude beyond popular coins like Bitcoin or Ethereum.

On top of that, BitShares was created as the first decentralized exchange ever made.

|

In a nutshell, that’s the essence of BitShares.

But he didn’t stop there. Realizing that a crypto exchange is mostly for tech-savvy individuals, he moved on to create something for the masses: Steemit.

Steemit is a social media platform — a normal-looking website where the users upload text, video and images. Others comment and vote on what they like. And the content providers earn points in the form of crypto.

It’s friendly looking. It’s easy to use. And other than a long alphanumeric password, it doesn’t throw up a series of walls that inhibit easy usage.

This is a big deal. Indeed, one of the main adoption barriers in the crypto world isn’t so much a platform’s speed or lack thereof. Nor is it necessarily state-of-the-art privacy features.

It’s how easy it is for average users to hop on board.

Larimer knew this was especially important for a social media platform. So he designed Steemit not only to be simple and engaging, but also to reward users for their time.

The effort paid off: Steemit today is the most used public blockchain platform in the world.

It has even more adoption than Ripple, a project that repeatedly boasts about its partnerships and adoption metrics.

Care to guess what might be the second-most-used blockchain project in the world?

Answer: The prior Dan Larimer creation I just told you about — BitShares.

Chalk up 2-for-2 for Larimer; he’s created the two most successful open blockchain protocols to date.

Now in June, Dan Larimer is Set to Release His Third and Most Ambitious Brainchild: EOS

Like I said, BitShares is an exchange. Steem is a social media platform. So obviously both are narrow, focused, clearly defined, single-application projects.

Not EOS! Instead, it learns an important lesson from Ethereum:

The crypto projects with the best chances of success of all are those that can allow the COMMUNITY to create the widest possible range of applications. And do it well!

With this goal foremost in mind, the EOS design is open-ended. It’s a big sandbox where anyone with the technical expertise can create any application they can dream of.

And here’s what’s so exciting about EOS: It’s not just a lot faster than Ethereum or other crypto platforms. It’s also much faster than Larimer’s own prior creations — Steem and BitShares.

So much so, that it’s rumored Larimer wants to create improved versions of both Steem and BitShares ON TOP of the EOS platform itself.

Imagine how much more useful — and powerful — EOS will be if he can run the two most successful open DLT projects in the world. Without missing a beat.

Warning: Don’t get carried away.

(At least not ALL the way.)

As often happens in crypto-land, anticipation of the upcoming EOS release in June has created some market euphoria.

Some of it well-deserved? Sure!

All of it? Not so sure.

Instead, it looks to me like EOS prices are now getting somewhat ahead of themselves.

Yes, there’s big long-term upside for this brilliant project. But prudent investors would be well-advised to wait for a substantial correction before jumping in with both feet. I say that for two reasons …

Reason #1: Some significant chunk of EOS’ recent price surge may have more to do with the glamor of its upcoming launch, and less to do with the glitter of its great technology.

Reason #2. The corporate folks behind the creation of the software have announced they will notbe launching the platform itself. Rather, they’ll let the community figure out how and when to release the MainNet.

This is a good thing. It holds true to a core philosophy of crypto — community participation and open-source solutions. But it could also create a bit of confusion about how this release is going to go down in the real world.

Another possible hiccup: Several organizations may decide to launch their own versions of the EOS platform, making it harder for some investors to ascertain what the “real” platform is.

I have no doubts the community will eventually sort it all out. But don’t be surprised if some temporary confusion becomes a catalyst for a much-needed correction in the EOS token.

If all this prompts the here-today-gone-tomorrow crowd to move on, great! It will be an excellent buying opportunity — not only for EOS but also for our 10 other high-rated projects.

Best,

Juan