Juan Villaverde hit the nail on the head a couple of weeks ago: He said a Bitcoin correction was due by mid-May, give or take a few days. And sure enough, it’s here.

The correction, he writes, is entirely within the context of a new, incipient bull market that should start building momentum in June. And part of that momentum is a growing chorus of establishment recognition for cryptocurrencies.

Take Michael Novogratz, for instance. He isn’t a household name, but he’s highly respected as a Wall Street insider from his days as a Goldman Sachs partner and as a Fortress hedge fund manager.

Now Novogratz is pounding the table about cryptocurrencies: “It’s almost essential for every investor to have at least 1% to 2% of their portfolio” in crypto, he says.

And he’s putting his money where his mouth is, investing 10% of his personal net worth in cryptocurrencies.

Or consider Saudi Arabia’s blockchain bootcamp. The kingdom’s Ministry of Communications and Information Technology (MCIT) is hosting a “blockchain bootcamp” to boost its labor pool of tech-proficient workers.

“The aim of this workshop,” they announced, “is to leverage Saudi Arabia’s untapped human resource potential, equip them with knowledge and insight, so they understand the power of blockchain and the current and future potential of its application.”

Central bank cryptos: Middle Eastern countries are already taking steps to embrace cryptocurrencies. In fact, the central banks of Saudi Arabia and the United Arab Emirates are working toward establishing a cross-border cryptocurrency exchange to finance transactions between the two countries.

What about the U.S. Federal Reserve — could we see a Fedcoin in the not-too-distant future? David Andolfatto of the Federal Reserve Bank of St. Louis proposes a digital version of a state-run currency, and the day could come when you pay taxes with a digital currency.

That may sound exciting (well, as exciting as paying taxes in a new way can get). But the great advantage of cryptocurrencies is that they’re decentralized. And that would be lost if they’re created and controlled by a central bank.

The real excitement, of course, is in the technology. Even if you’re not an early adopter of technology yourself, you can find great profit opportunities within the stocks that embrace it earlier than others.

Important: Cryptocurrencies aren’t the

only way to profit from the boom in

Distributed Ledger Technology (DLT)

In parallel with the boom in cryptocurrencies, the technology of blockchain — or, more broadly speaking, Distributed Ledger Technology (DLT) — is fueling a new round of transformational investments in many industries, especially energy.

For example …

Cleantech Group tracks 53 such deals involving a total of $739 million in 2017, plus another 15 deals with $359 million in the first quarter of 2018.

Forward-thinking energy companies that incorporate blockchain technology into their business model will be among the best energy stocks to own.

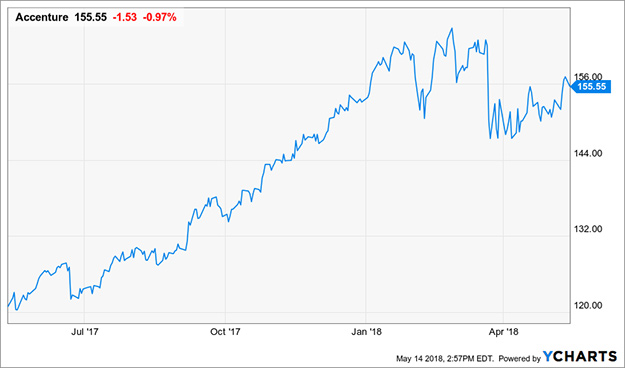

Global consulting giant Accenture has developed a blockchain solution that it claims will save maritime shipping companies hundreds of millions of dollars per year.

|

| Talk about Blockchain Bootcamp. Accenture (ACN) posted 537 blockchain job openings last year. Its shares are up 28.6% year-over-year. |

“Our trials have proven the viability of a shipping process in which many documents can be replaced by secure and distributed data sharing with clear and defined ownership. This gives companies a significant opportunity to save time and money while improving their service to customers.”

Those are just two of the many examples already taking hold. And this revolution has barely begun!

Best wishes,

Tony