Here’s why you shouldn’t touch ’em with a ten-foot pole

Cryptocurrency technology is advancing at an accelerating pace. And with each step in its evolution, landmark innovations are introduced.

Ethereum gave us Smart Contracts. NEO, EOS and Cardano have added greater speed and better governance. Hedera promises to do all of that plus much more.

At the same time, however, we see a slew of supposedly “new and innovative” cryptocurrencies that are little more than copycat regurgitations of prior projects.

That’s what makes the Weiss Cryptocurrency Ratings so critically important for investors. They provide an objective measure that distinguishes good projects with promise for the future from mediocre projects that will likely be discarded.

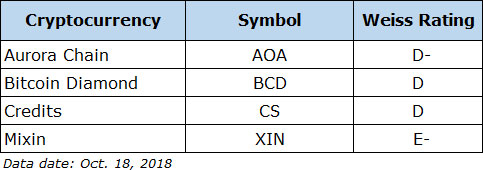

Today, we name four examples of cryptocurrencies that we have recently begun rating and that merit a grade of “D” (weak) or lower. The four are summarized in the table below.

|

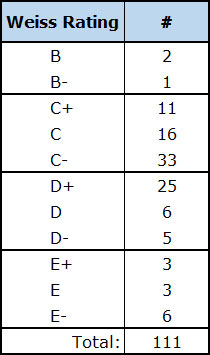

Please be aware that these represent strictly a sampling of the 48 cryptocurrencies meriting our Weiss Ratings of “D+” or lower.

Overall, among the 111 currently we rate, the distribution of grades is as follows:

|

For each cryptocurrency, we review thousands of data points and dozens of indexes we have created to measure each key aspect of a coin’s technology, adoption, investment risk and investment reward.

Although several cryptocurrencies merit “A” grades for their technology or adoption, none get A’s when also considering the risk/reward trade-off that investors currently face. (This aspect is expected to improve, however, as prices resume their ascent and the cryptocurrency markets mature.)

Bitcoin, for example, gets an “excellent” score for adoption, but only a “fair” score for technology. Its investment risk is “fair,” while the investment reward is “weak.” Its overall Weiss Rating remains “C+.”

In contrast, EOS merits an “excellent” technology score and an adoption level pegged at “good.” Although its risk and reward are still “weak,” the strong combination of technology and adoption help elevate its overall score to a “B.”

Why do we give Aurora Chain, Bitcoin Diamond, Credits and Mixin such low grades? Here are some excepts of the commentary we have recently provided to subscribers of our Weiss Cryptocurrency Ratings service.

Aurora Chain (AOA)

Weiss Rating: ‘D-‘

This crypto ranks a respectable 75th in market capitalization among the 2,000-plus cryptos in the Weiss Ratings database, indicating some interest from investors.

But we believe it’s more a testament to hype and misinformation than any real substance. At the same time, we see a series of red flags:

Red flag #1. Consensus algorithm. Aurora trumpets Delegated Proof-of-Stake (DPoS) plus Byzantine Fault Tolerance (BFT) as if it were some kind of unique combination. It isn’t.

Red flag #2. Smart contracts. What the Aurora whitepaper has to say about this key topic seems to have been lifted straightaway from Wikipedia. Either the authors don’t know what to write or they think readers don’t know how to use Google.

Red flag #3. Where are the programmers and developers? They are not identified by name. There are no bios. And on its website, Aurora gives only a list of “community managers on social media.” So, who’s in charge and who’s building what? It seems nobody knows.

Red flag #4. No visible computer code. Crypto without code is like smoke and mirrors.

Red flag #5. Sparse adoption metrics. With no visible project, the only adoption metrics we could find relate to Aurora’s ERC-20 token, which lives on the Ethereum network. But it has no functionality.

Red flag #6. Very weak trading volume. In fact, the coin is only listed on a single crypto exchange, making it very hard to trade.

Bitcoin Diamond (BCD)

Weiss Rating: ‘D’

BCD is a Bitcoin clone that dates from the heady days of late 2017, when cryptocurrency prices were roaring and cloning Bitcoin was a favorite get-rich-quick scheme.

Developers downloaded the open-source Bitcoin code. They made some minor changes. They hyped up the coin as “the next big thing” in crypto, enticing investors to jump in. They awarded themselves generous chunks of their new crypto. And then they cashed out by selling their Bitcoin Diamond holdings in exchange for the original Bitcoin.

What improvements did they make in the code? Virtually none.

First, they increased the coin’s maximum supply from Bitcoin’s 21 million to 210 million, arguing that a higher token supply is more likely to be used in ordinary transactions than Bitcoin.

Not true! The reason people don’t spend Bitcoin is because it’s a deflationary asset and they expect prices to go up over time. That’s true whether the total circulation is 21 million or 210 million.

Second, they came up with an algorithm that supposedly prevents big mining companies from developing specialized mining hardware that drives small-time miners out of business.

But it’s just a temporary patch! Deep-pocketed crypto-miners will always be able to come up with new hardware to optimize any algorithm under the sun.

Meanwhile, Bitcoin Diamond inherits all the technological weaknesses of the original Bitcoin. But it enjoys only limited support for the Lightning Network, which Bitcoin is adopting to speed up transaction processing.

It has only a tiny community of users. Developer support is virtually nonexistent. And very few transactions are actually being performed on its network.

Credits (CS)

Weiss Rating: ‘D’

This crypto’s developers boldy proclaim they can do a million transactions per second.

Sound familiar? It should, because multiple wannabe Ethereum-killers make similar claims.

But for evidence, all they have are tests conducted in a highly controlled environment with a small number of machines. That’s far from an accurate representation of what happens in a live, real-world environment.

Nowhere can we find a credible explanation of precisely how the platform will achieve its lofty speed goals.

Other issues are also glaring:

Busted encryption: Early on, the Credits development team decided to use the MD5 hashing algorithm in the design of their platform. We believe this was a sophomoric mistake.

Without delving into the technical details, one thing is abundantly clear: MD5 is famously vulnerable to security breaches.

Nor is this a new discovery. Back in 2008, for example, America’s Department of Homeland Security warned:

“Users should avoid using the MD5 algorithm in any capacity. As previous research has demonstrated, it should be considered cryptographically broken and unsuitable for further use.”

Why didn’t Credits developers know about this last year — when they were designing their platform? And why didn’t they acknowledge MD5’s security flaws or switch to a different algorithm until earlier this year?

Why didn’t they choose a secure algorithm to begin with? Is the question. Their response: We were in a rush.

Really? Since when is it shopping for hashing algorithm especially time-consuming? You could probably choose between regular and high-octane gasoline in pretty much the same amount of time.

So for us, this whole MD5 episode is another red flag.

False claims: Credits claims it uses a “groundbreaking new consensus algorithm.” Baloney! Many other third-generation crypto platforms — like EOS, Steem, BitShares, Ark, Cardano, NEO and Lisk — use the same one or very similar.

While there are some differences that could make Credits’ consensus algorithm unique, we have yet to see solid evidence on how their ‘Credits specific dPoS and BFT’ will be any faster than any of these other projects. So we remain skeptical that this new consensus algorithm can deliver on their promise of 1,000,000 transactions per second.

More hype: Marketing materials dazzle with hot-button, crypto buzzwords. So much so that they raised a hefty $20 million at their Initial Coin Offering (ICO) earlier this year.

Likewise, the Credits whitepaper waxes eloquently on DLT-related topics, while still shedding very little light on specifically how it will accomplish its ambitious goals.

This is shady at best. And it explains why some analysts suspect this project may be nothing more than an elaborate scheme to separate first-time crypto investors from their money.

Mixin (XIN)

Weiss Rating: ‘E-‘

The folks behind Mixin claim to have a fix for just about every problem that has plagued cryptocurrencies from the very beginning.

They say they intend to build a decentralized exchange that can trade any crypto asset for another, using state-of-the-art technology that’s

resistant to attacks, that guarantees finality and nearly infinite scalability.

But digging deeper, we find that …

- There’s suspicion the developers’ LinkedIn profiles may be faked, and their Reddit page has barely a dozen subscribers.

- The dApp that’s supposed to connect with the Mixin network doesn’t work.

- The Mixin whitepaper contains no technical details on how this amazing, never-before-seen Swiss Army knife of crypto will be built. What it contains instead is a lot of hand-waving: “We know this appears to be centralized, but it’s actually very decentralized.” Sheesh!

- GitHub, where most crypto developers converge to publish and upgrade code, contains no reference we know of to any of the code that the Mixin whitepaper describes.

With a non-functional app and no programming code to analyze, all we have is their XIN coin, just one of thousands of tokens on the Ethereum network.

Moreover, with virtually no social media presence, almost no end-user awareness, no code being built and no transactions taking place, adoption and usage metrics are abysmal across the spectrum.

My recommendation: Don’t touch these four coins with a ten-foot pole.

Best,

Juan