Bitcoin Crash!? Again?

Last week, we caused global outrage with our C+ rating for Bitcoin. We were cursed, ridiculed and laughed at. One group even tried to mount a cyberattack against our Weiss Ratings website.

But yesterday, the price of Bitcoin plunged from $10,908 to $9,723. Nearly 11% in just 13 hours.

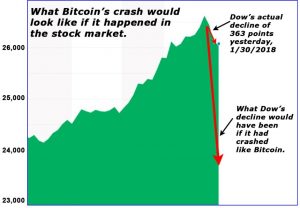

If that happened in the U.S. stock market, it would be a 2,846-point collapse in the Dow Jones Industrials.

On the Dow chart of the last two months, it would look like this:

You’d see the shock and awe in this morning’s news headlines:

“LOOK OUT BELOW!” …

“WORSE THAN 1929!” or …

“WALL STREET DUMPS ON TRUMP!”

But in the crypto world, even with 10% crashes, most folks barely bat an eyelash.

Crashes of 10% or more in a single day are not uncommon. They happen pretty frequently, actually. So do 10% surges. Also common: 10x gains like Bitcoin investors saw in 2017.

That’s why most Bitcoin lovers are long-term buy-and-hodlers.

No, that’s not a typo. It’s crypto-slang for the old-timers in the market since the early 2010s, many becoming millionaires and billionaires simply by sticking with it through thick and thin.

What about last year’s horrible Christmas Crash that saw Bitcoin plunge from an intraday peak of about $20,000 to less than $10,000 in two weeks flat?

“Bah! We don’t care,” say Bitcoin veterans. “And if Bitcoin made you millions or billions of dollars like it did for us, you wouldn’t care either. We’ve seen the same thing happen before, or worse. After the last big crash, Bitcoin surged more than 20-fold. We love Bitcoin. That’s why we’re hodlers and always will be.”

So you can imagine their outrage last Wednesday, when we announced the first-ever crypto ratings and had the audacity to peg Bitcoin at a lowly C+ (“fair”).

Best wishes,

Martin and Juan