With all the millennial-aged snowflakes making fools of themselves on TV and stumping for socialism, it’s easy for the baby boomers (including me) to dismiss them as naive, entitled brats.

Heck, I remember my parents’ generation saying similar things about me and my fellow boomers because of our long hair, psychedelic music, tie-dyed T-shirts and anti-war protests.

But the same process seems to play out with each generation. Before becoming old and wise, you have to first be young and dumb. The baby boomers turned out just fine, and I expect the same will be true of today’s snowflake generation.

In fact, I think millennials could become wildly more financially successful than baby boomers. That’s because they are infinitely more tech-savvy and early adopters of new technology.

One new technology where millennials are leading the charge is with the kind that powers the cryptocurrency universe.

Cryptocurrencies are a complete mystery to most of the people of my generation. That’s a key reason why only 8% of Americans have purchased a cryptocurrency so far.

But that is going to change in a big way, and millennials know it.

A new study from Accenture found that 13% of 18- to 24-year-old millennials already use digital currencies on a daily/weekly basis. But an impressive 26% expect to use digital currencies “daily or weekly by 2020.”

In fact, millennials are twice as likely as any other generation to own cryptocurrencies.

Don’t dismiss that cryptocurrency enthusiasm for youthful exuberance, either. One other group of Americans are big cryptocurrency fans: the very rich.

Accenture found that 19% of wealthy Americans have invested in digital currencies and a whopping 32% expect to by 2020.

“This debate will likely continue as digital currencies mature, but it is not stopping consumers from using them. Among all payment instruments included in the Accenture survey, respondents expect the biggest boost in usage from today to 2020 to be in digital currencies,” said the Accenture report.

What are the characteristics of cryptos that millennials and the wealthy like so much?

- Anonymity: 36% of respondents

- Transaction security: 36%

- No government control: 20%

- Low-cost trans-border transactions: 15%

Cryptocurrencies are similar to gold in that they are alternatives to dollars, euros, yen and other government-backed paper currencies.

|

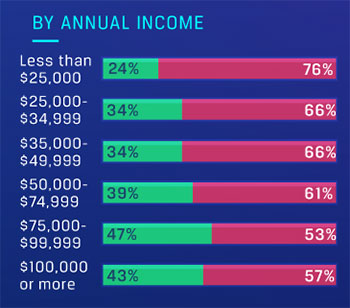

| High earners are more likely to invest in cryptos, according to blockchain-focused research company Clovr. See its survey results about who is investing in cryptos here. |

But for all the yellow metal’s benefits — it’s a store of physical wealth, its scarcity all but ensures its value will continue to go up, and it offers privacy from prying government eyes — gold is also a cumbersome, inefficient medium of exchange.

Meanwhile, cryptocurrencies are technologically superior — safer, more secure and unhackable — than credit cards and online banking.

Many businesses already see that. And there are many more to come …

Thousands of companies — such as Microsoft, eBay, Expedia, McDonald’s and Subway — accept digital currencies for payment. The Swiss government accepts Bitcoin for tax payments, and Dubai plans on becoming the world’s first “blockchain city.”

Related story: This university not only invests in cryptos, but even accepts Bitcoin for tuition payments

The digital gold rush is coming, and there is every reason to believe it will be the most profitable investment opportunity of our lifetime.

One response from the Accenture study that stood out to me was that the 38% of the people surveyed said they have a “poor” understanding of digital currencies.

Please, don’t be part of that uniformed 38%. Click here and I’ll help you make sure of that.

Best wishes,

Tony